In regards to tying the knot in One of the more iconic towns on this planet, getting the appropriate Las Vegas wedding ceremony photographers will make all the main difference. Las Vegas is noted for its lively Electrical power and gorgeous venues, rendering it a really perfect place for your memorable marriage. Whether or not you happen to be pla

Transform Web page to Cellular App Designed Basic: Join Our No cost WebViewGold Workshop

In an era wherever mobile technological innovation reigns supreme, corporations have to preserve tempo by ensuring their products and services are conveniently available on smartphones and tablets. An amazing way to attain this is to transform Internet site to cell application. In case you’ve been thinking about this transition but don’t know w

Elevate Your Exercise session Design and style with High quality Athleisure Clothes

Lately, athleisure outfits has revolutionized the best way we approach Health and fashion. This functional style lets individuals to seamlessly transition from workout periods to every day actions with out compromising on ease and comfort or fashion. Athleisure Clothing combines superior-efficiency fabrics with stylish styles, rendering it an esse

Bouncy Residence Employ: Making Occasion Exciting Simple which has a-Leap Castle Seek the services of in Brisbane

Organizing the proper social gathering could be demanding, but including a contact of enjoyable and exhilaration has not been less difficult thanks to Bouncy Household Employ the service of solutions. A-Leap Castle Use in Brisbane supplies a hassle-no cost Resolution for anyone wanting to inject daily life into their events with inflatable leisure.

Stunning Long Island Wedding day Flowers for the Distinctive Working day

When arranging a marriage, picking out the proper bouquets is vital in making the perfect environment for the Distinctive day. Long Island Marriage Flowers give a wide array of choices that cater to numerous tastes, themes, and budgets, making sure each and every couple finds their best floral arrangement.The Importance of Very long Island Wedding

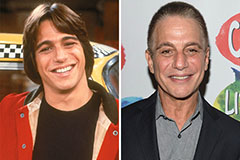

Tony Danza Then & Now!

Tony Danza Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!